TOWN OF WIRT TOWN TENTATIVE BUDGET MEETING MINUTES

Town Hall, 210 Main St., Richburg, NY 14774

September 27, 2023 (approved)

PRESENT

Supervisor: Tricia Grover Deputy Supervisor: Michael Scott Councilpersons: Larry Bedow, Darla Ostrum (Brent Howard, absent). Also Present: Town Clerk, Nicolette de Csipkay; Michelle Dunbar, bookkeeper; Curt Rung, Highway Superintendent; Sue Rung, John Sheets.

The September 27, 2023 Tentative Budget Board Meeting was called to order by Supervisor Tricia Grover with the Pledge of Allegiance at 6:00 pm. Attendance was taken by Nicolette de Csipkay, Town Clerk. Bookkeeper Michelle Dunbar distributed copies of the 2024 Tentative Budget to all Board members present. The following changes were made to the 2024 Budget:

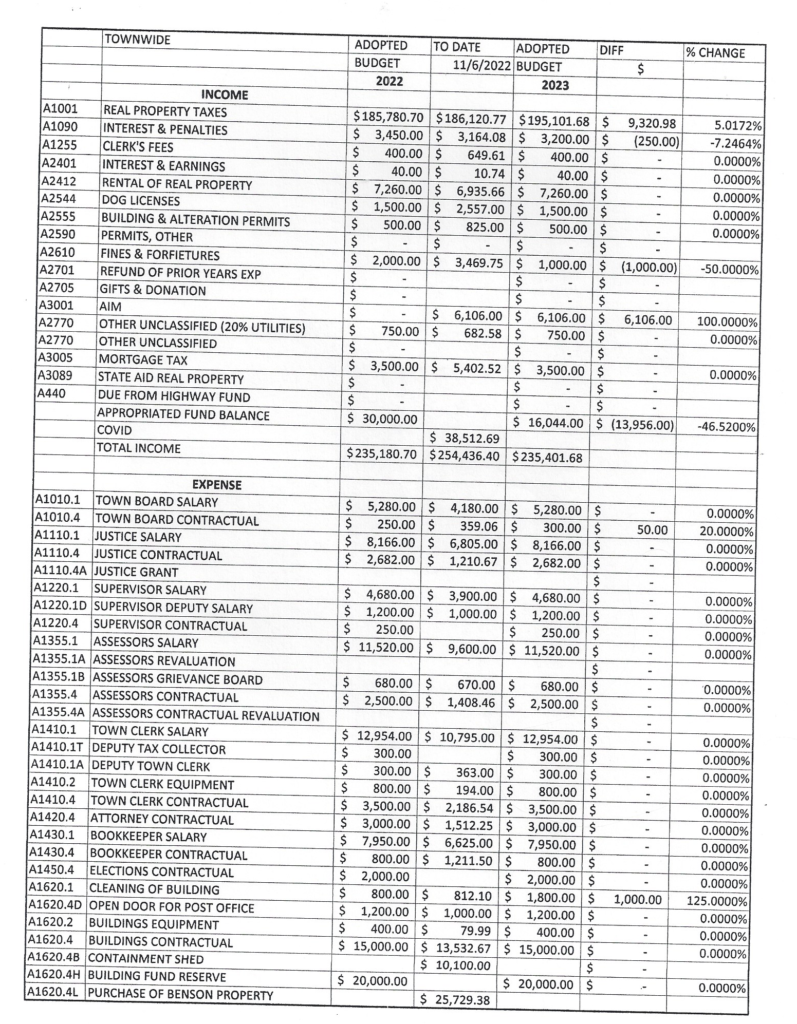

Income:

A1090 Interest & Penalties was increased from $3,200 to $3,500.

A2401 Interest & Earnings was increased from $40.00 TO $2,400.

A2610 Fines & Forfeitures was increased from $1,000 to $2,000.

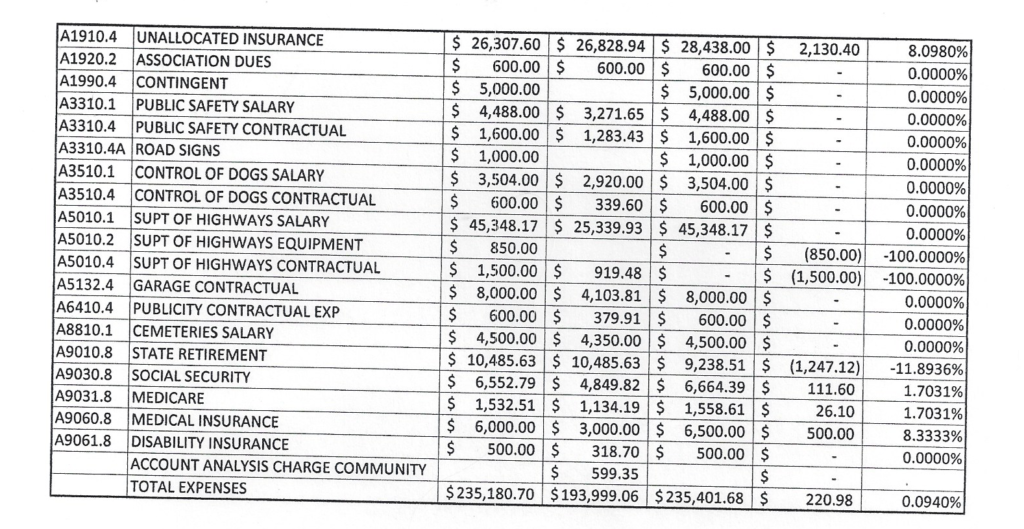

Expenses:

A1010.4 Town Board Contractual was increased from $300 to $350

A1430.4 Bookkeeper Contractual was increased from $800 to $1600.

A1620.4D Open Door for Post Office was closed.

A1620.4 Buildings Contractual was increased from $15,000 to $19,600.

A1910.4 Unallocated Insurance was increased from $28,438.00 to $33,200.00.

A5010.2 Supt of Highways Equipment was increased from $0.00 to $400.00

A5010.4 Supt of Highways Contractual was increased from $0.00 to $650.00.

A9010.8 State Retirement was decreased from $9,238.51 to $7,078.50.

A9060.8 Medical Insurance was increased from $6,500 to $13,950.36.

Account Analysis Charge was closed, and $600 was added to A1620.4 (already reflected in number above).

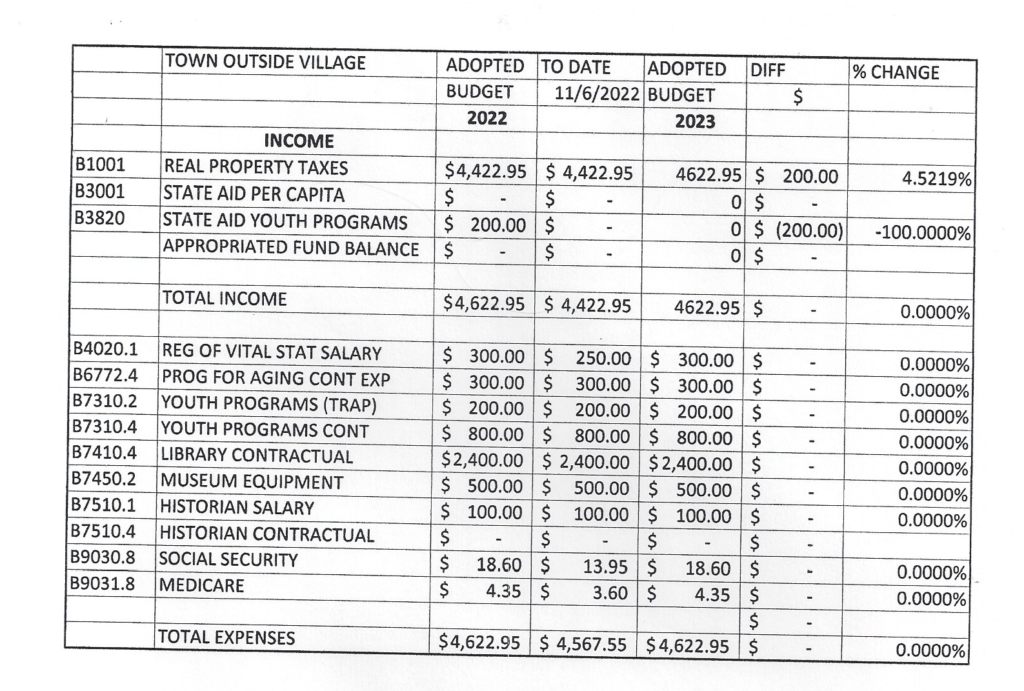

B7310.2 Youth Programs (Trap) was increased from $200 to $600.

B7410.4 Library Contractual was decreased from $2,400 to $2,000.

Income:

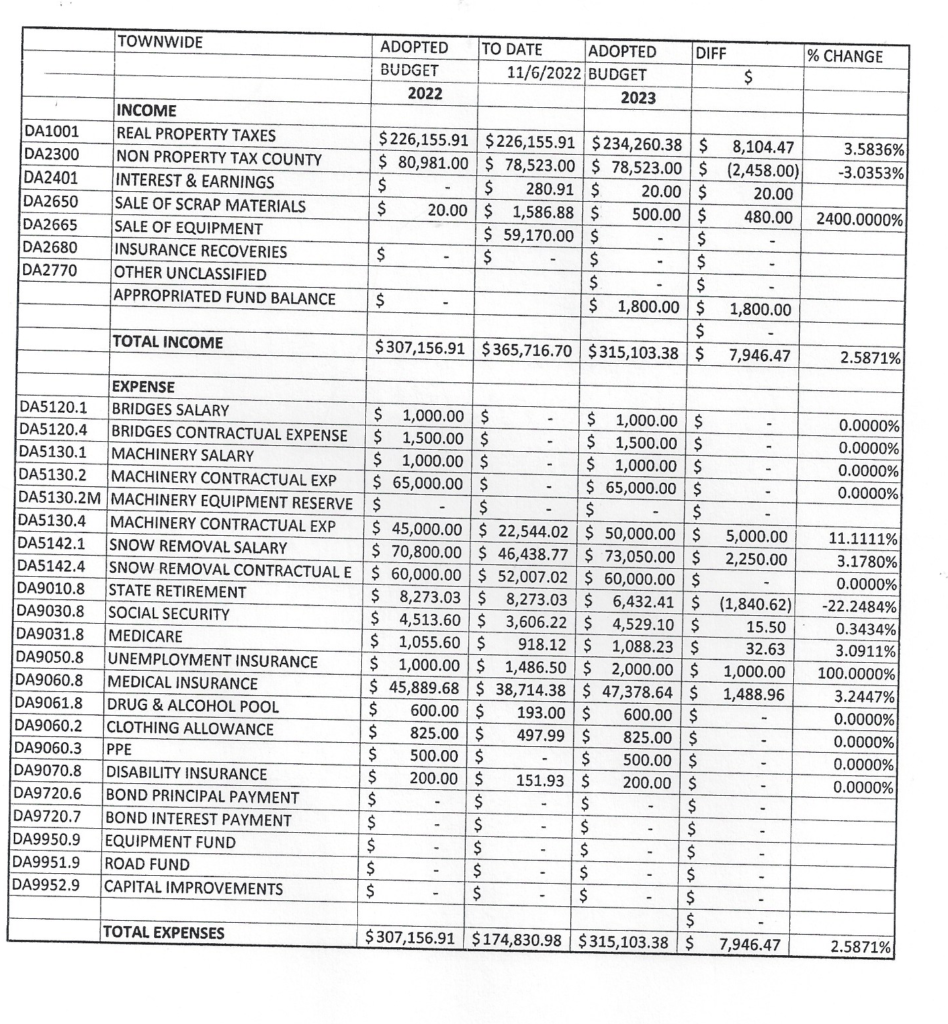

DA1001 Real Property Taxes increased from $234,260.38 to $236,602.98

DA2401 Interest & Earnings increased from $20.00 to $2,500.00

DA2300 Non Property Tax County increased from $78,523.00 to $82,949.80.

DA2655 Sale of Equipment was increased from $0.00 to $500.00.

Appropriated Fund Balance was increased from $1,800 to $8,296.14.

Expenses:

DA5130.1 Machinery Salary increased fro $1,000 to $10,000

DA5142.1 Snow Removal Salary increased from $73,050.00 to $78,500.00

DA9010.8 State Retirement was decreased from $6,432.41 to $5,877.40.

DA9030.8 Social Security was increased from $4,529.10 to $4,867.00

DA9031.8 Medicare was increased from $1,088.23 to $1,297.75.

DA9060.8 Medical Insurance was increased from $47,378.64 to $48,806. 77.

DA9060.2 Clothing Allowance increased from $825.00 to $900.00

DA9060.3 PPE decreased from $500.00 to $300.00

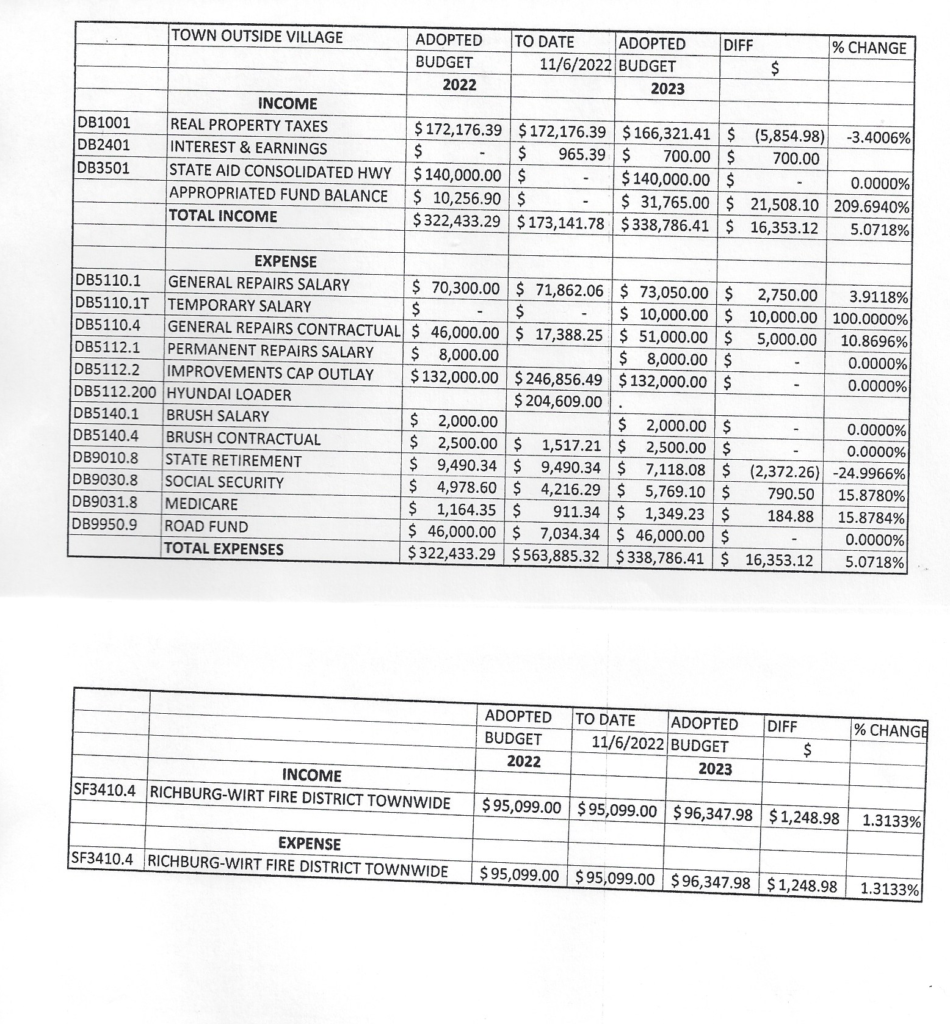

Income:

DB1001 Real Property Taxes increased from $166,321.41 to $167,984.62.

DB2401 Interest & Earnings increased from $700.00 to $5,000.00

Appropriated Fund Balance increased from $31,765.00 to $41,514.23.

Expenses:

DB5110.1 General Repairs Salary increased from $73,050.00 to $85,000.

DB5110.4 General Repairs Contractual increased from $51,000.00 to $55,000.00. DB5112.2 Improvements Cap Outlay increased from $132,000 to $250,000

DB5140.1 Brush Salary increased from $2,000 to $2,500.00

DB5140.4 Brush Contractual decreased from $2,500 to $2,000.

DB9010.8 State Retirement was decreased from $7118.08 to $6928.10

DB9030.8 Social Security increased from $5769.10 to $6541.00

DB9031.8 Medicare increased from $1,349.23 to $1,529.75

DB9950. Road Fund decreased from $46,000 to $45,000.00

Adjournment of Meeting– The meeting was adjourned at 8:20 p.m., with the next Tentative Budget Meeting to be scheduled at the next Regular Board Meeting on October 9, 2023. Respectfully submitted by Nicolette de Csipkay, Town Clerk

/

/

/